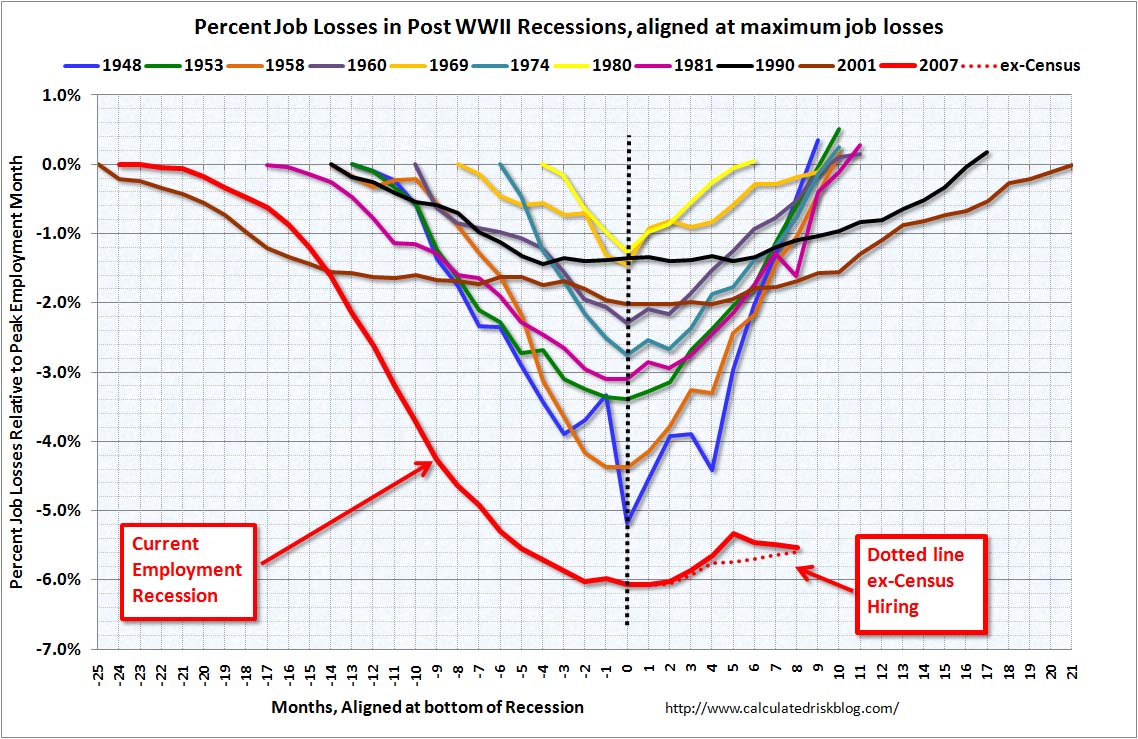

You’ll find this chart replicated all over the net. I sourced it from calculated risk but it’s referenced in countless other locations as well. I have no indication that it is incorrect.

Those of you who are bad at math or Obama fans can take a powder for the rest of this post. For everyone else I have a question. (You didn’t all bail did you?)

Let’s get the initial (and obvious) reactions out of the way:

- This is bad.

- This is not good.

- No matter how much the press tries to shove unicorns up your ass about how the recovery started an hour after Obama won the election, this is still weak economic performance augmented with turbo jets of suck.

- Printing a metric shitload of non-existent money didn’t help. See #3. (I am not surprised. There isn’t enough Kool Aid to convince me that amassing debt to destroy old Volvos magically creates prosperity.)

- This is the worst unemployment “shift” (flush?) since 1948. Seventy two years is a long time bubba!

- Grrrr.

Ok. Have we gotten all that out of our system? Good.

Because here’s my Curmudgeonly question. Why? Why should 2011 have so much unemployment for so much longer?

The previous seven decades had plenty of mismanagement. There have been wars, pestilence, drought, and disco. Why the long period of suck this time? How did did we eclipse everything since President Truman?

Never fear, I have a theory! Either I’m seeing an underlying reality or I’m way off. (Please comment. If I’m wrong I’d like to know so provide your interpretations! Hint: calling me an asshole is not a well reasoned argument.)

I believe that unemployment is higher now and is staying high longer because virtually everything we’ve done for decades has made unemployment a more tenable situation. Regardless of intention, most Federal fiscal policy can be viewed as if the goal was to keep people out of the workforce as long as possible…possibly most of their life. Perhaps the chart shows the demonstrable “success” of such policies?

Think about what differs between now and the past. You know what we didn’t have in 1948? Extended unemployment benefits. Surely cash payments make being unemployed a lot easier than otherwise. Nor did we have an unofficial immigration policy that counts on millions of illegals to be a shadow workforce. (Semantic note: they are not “undocumented”…they are illegal…as in breaking the law.) Reasonable people can disagree about immigration but surely illegals picking cabbages in a shadow economy distorts the documented worker’s economy. Regulatory hassles? In 1948 you told an employee to show up and paid them cash. If they sucked, you fired them. In 2011 you need an HR department to avoid lawsuits, an accounting department to generate 1099 forms, and firing anyone becomes an issue. Certainly that’ll discourage hiring.

And of course the biggest change of all is the rise of two wage earner households. When you lose one of two paychecks it’s dire. It’s also a common situation in 2011. Losing the single and only household support is 1948 style bad news and it’s catastrophic and total!

In 1948 you’d work, get paid, or starve. In 2011 there is a vast network of complexity that eases the transition from wage earner to welfare consumer. Presumably the better the welfare state and the more programs that smooth the transition…the longer a person is likely to stay unemployed. Why not?

BTW I’m not trying to disparage the unemployed. Getting laid off sucks…and it hurts. I’ve been there too. I’m just saying that welfare and it’s associated programs, regardless of intention, provide an incentive and opportunity to stay unemployed longer. Which is precisely what the chart is showing…more people are staying unemployed longer than we’ve seen since WWII.

So is the chart showing the “success” of policies that subsidize unemployment and penalize wage-earners? Of is it just the worst bad news in 70 years and me overthinking things?

Now, because I’m such an optimist, I’m going to add a ray of hope. It’s bad but it’s not 1939 bad. We’re not fighting on the streets for turnips. Kansas hasn’t gone Mad Max because rains screwed up the corn crop. Aside from Detroit (which is always screwed) and a few deeper blue states like New York, Illinois, California, and Minnesota (which all made decisions that are coming home to roost right now) the nation hasn’t totally shit the bed. The lights are on. The streets are filled with cars. Wal-mart still stocks food. People are still buying food. (Possibly more with welfare money and fewer with wage money?) Canada hasn’t attacked. The Russians haven’t launched ICBMs. The numbers suck but you can walk down a lot of streets in America and things superficially look ok.

This too would match my unusual interpretation of the chart. Policy has encouraged a situation where gainful employment in 2011 is a “lifestyle choice” as opposed to 1948 where gainful employment was the alternative to being a hobo and eating roadkill. (For the record, I once hit a deer with my car and after morning the car butchered the deer and stuck it in the freezer So I’m not making fun of hobos either.)

In the long term the numbers are bad. Making gainful employment an option is not a good thing for society. It’s not good here and it’s not good anywhere. (I can’t believe I’ve got to say that after we all watched mighty Russia collapse!) The EU’s problem children of Portugal, Italy, Ireland, Spain, and Greece are not a good portent. America’s problem children of over extended States is the same thing. So yeah, long term we’re all gonna’ die but does the dissonance between numbers that say “we’re going off a cliff” and a society that still has gas at the pumps and Nintendos in Wal-mart say that the welfare state is doing precisely what it was designed to do?

Here’s the thing, though…there are lines on that chart for every official recession since WW2. I can’t speak for what the situation was in the 50s and 60s, but the overwhelming majority of those changes you cite since 1948 have been in place for decades. If they’re the cause of the current mess, together or seperately, why didn’t they do the same thing in the recessions of 1974, 1980, 1981, 1990, and 2001?

(Long-term welfare recipients don’t count as “unemployed” in those statistics, BTW. The only people counted are the ones who held a W2 job recently enough and long enough to now be collecting unemployment compensation. With the exception of people like me who work on a contract basis, that’s not a very high hurdle to clear, of course, but it does exclude most of the culture-of-poverty types who pad the welfare rolls year in and year out.)

Could it be that perhaps many of the jobs that went away this time aren’t coming back? Generally speaking, globalization has shifted manufacturing to countries with cheaper labor. Technology has made individual workers more productive. It has also facilitated some movement of service sector jobs to other places (e.g., call centers in India).

And I won’t even go into what the dumbing down of the education system has done to the quality of American graduates, which encourages employers to look elsewhere for qualified employees…

“If they’re the cause of the current mess, together or separately, why didn’t they do the same thing in the recessions of 1974, 1980, 1981, 1990, and 2001?”

79-80 wasn’t that big a recession, 1981 was in the middle for job losses,… but the job recovery took the longest of any before it. 1990 and then 2001 took even longer to recover according to the chart, more than a year and a half. The eight recessions previous to those last 2 recovered all jobs in 1/2 the time.

2007 will surpass those 8, barring a miraculous recovery in the next couple months, and according to that trend-line is on pace to take longer than ever to get back to pre-recession levels.

The data would seem to prove the theory. But the theory might not be complete. I to believe that the welfare safety net makes things easier. The immediate need to get back to work is not there as it once was. Nor, would it seem that the need to stay employed…. Why did we lose so many more jobs this go round??? Are times really that much worse than the last 10 recessions?? No? No one eating gopher stew? not just eating,… but fighting packs of people over garbage cans?? No??

I think there is more to the story than just the welfare state,

Our world has become so over regulated and with governments trying to create more incentives/laws/regulations in the market place. It becomes more difficult for a business to comply, or even understand. The government is not your friend. A quick change in a law here or a regulation there can cost you major $$$. It is easier to play it safe and try to avoid taking risks. For example in Saskatchewan someone is trying to push a law that would end up that no one was allowed to work night-shifts alone for safety. Imagine a quick doubling of labour costs in a small business with only a couple employees. Better for a business to be conservative in hiring to be prepared for whatever next (idiotic) regulation might pop up.

On top of that one of those regulations is a minimum wage. It has nearly doubled in Saskatchewan in the last 10-12 years. That’s about a 7% wage increase a year. Tough for a business to absorb. And cheaper to run on minimum staff under the circumstances. Reduce a $10 minimum wage by $1 (10%) and a business could afford 10% more employees. Well ok, it wouldn’t directly transfer because of profit taking, reduced prices, etc. But with thinner margins because consumers are tighter with the $$$. A business has to find more efficiency’s And when you can’t pay less, you can still do with 1 less. (Something governments need to learn about the extra people in their employ)

.

Its not just that the government has made it easier and less damaging to be out of work with the welfare state, They have also regulated,scared, and priced businesses out of hiring employees that they would have hired as a matter of course just a few decades ago..

These comments got me thinking (always a bad idea). There’s room for improvement in my half-baked theory.

Barcs mentioned inflexibility caused by regulation as a contributing cause of the length of unemployment. Good point. I left that out.

Matt said that the changes I mentioned as increasing length of unemployment have been in place since 1948. Why should they only show up now? I posited a gradual increase in the effects I listed and thus expect a proportionate increase in length of unemployment over time. The chart might show it. Barcs thinks it does. I’m not sure if this chart could necessarily prove it one way or another. To associate time (more recent) with increasing length of unemployment is tough with all the “noise” caused by government manipulation of the economy. I think it’s tough to be sure if it’s a gradual increase with each recession getting longer (my pet theory) or it’s more random with this time going off a cliff. It could be a little of both.

CenTexTim suggested jobs were going overseas. Much as Matt said the things I complain about have been going on a long time I’d say shifting manufacture overseas has been going on for a long time too. More now than in the past? Possibly.

Matt mentioned that habitually unemployed multi-generational welfare folks wouldn’t show up on this chart. He’s right. What would show up (and look like increased length of unemployment) is a former workforce member turning into a full time welfare zombie. Which is what I suggest might be happening…at least it’s a situation that’s less socially shunned and more fiscally palatable than it once was. I jokingly say that in the good old days, a man who couldn’t hold down a job simply wasn’t going to get laid. A good social policy!

One last thought. The trough is a function of how high employment rates were before the shit hits the fan. (Freedom’s just another word for nothin’ left to lose!) The current trough started with very low unemployment…so it’ll look deeper relative to recessions that began with moderate unemployment. (Same thing with financial loss. Bankers weeping as they turn in their leased Saab to accept an old Chevy aren’t experiencing the same emotions as someone who starts with a shitty Chevy and keeps driving it.)

The depth of the unemployment trough shows how “full employment” is a radioactive statistic. There is a point where everyone who is willing and able to work is employed. In such a situation unemployment could be people intelligently and deliberately accepting a few months unemployment as the opportunity cost of shifting into better jobs. Plus the workforce will always have a few percent of hangers on who just can’t hold it together. So “full employment” is a number greater than zero; possibly something like 5%? That number and a little creative accounting will always allow the government to invariably give unemployment benefits to a few percent of the workforce even in the best of times. (Which doesn’t mean I think it’s a bad thing short term.) The current situation started with just about everyone who wanted a job and could get dressed in the morning without their Mom making them…in a job. As close to full employment as we’re likely to see in a free people with underlying social support. Indeed it’ll be hard to get back there…one way to do it is to shift parts of the population out of the “willing to work” category; student subsidies, retirements, etc…

One last note. With unemployment so high. What goods and services are consumers with cash not finding? Store shelves are stocked, businesses are open, goods are still moving, etc… I’m not seeing a lot of “lost labor” shortages. (Which is a very good thing too!)

You’ve nailed it.

Rewarding failure produces…More failure.

Punishing success produces…..Less success.

Now how does increasing taxes ( punishment) on the rich ( successful) help things?

Hint – it don’t.

Pingback: Why The Recovery Feels Like Crap | Bearing Drift