Read this:

“…we found that both kinds of debt had positive effects for young people. It didn’t matter the type of debt, it increased their self-esteem and sense of mastery.”

Basically a study found that young people who have lots of debt (both student loans and credit cards) have high self esteem and “sense of mastery” (whatever the hell that is). From that they concluded that young people must derive them from the debt.

I disagree. Say it with me folks: correlation is not causality.

If I win the lottery and then slip on a banana peel it is not true that lotteries cause bananas or vice versa.

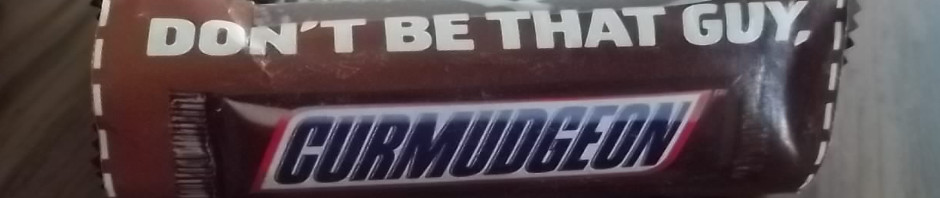

My curmudgeonly theory (which is just as likely as anything) is that if you’ve got a ton of self esteem (and the aforementioned “mastery”) you’ve got a personality that’s willing to amass more debt. Maybe you’re a risk taker. Maybe you’re willing to “invest in yourself” (based on the old fashioned idea that student loans facilitate the education that’ll land you higher paying jobs). Or maybe you’re arrogant, reckless, or lacking in impulse control.

This is a correlation…not causality. And because I know the difference I won’t conclude that journalism degrees cause people to misinterpret science but only that the two tend to go together.

One more thing:

“…the results suggest that debt can be an important resource for young adults that allow them to make investments that improve their self-concept.”

Two things:

1. Debt is not a resource. Ever. To anyone. Access to credit might give you options but debt alone (as opposed to what you might have bought with it) is inherently negative. It never improved the financial picture for any person, corporation, organization, or nation. It simply isn’t positive. How hard can that concept be?

2. If you need a better “self concept” (whatever the hell that is)…earn it. Self esteem, like love, honor and pride, cannot be purchased.

I’ll get off my soapbox now.

A.C.

Hat tip to Living Freedom.

Post hoc ergo propter hoc

I hit Google translate and it said “Yoda just took a shit in my Cadillac.”

Luckily I know that it means a logical fallacy. “After this, therefore because of this.”

I’m a new reader of your blog but I must take issue with your statement that “…debt alone is inherently negative. It never improved the financial picture for any person, corporation, organization, or nation.”

That may be true in the abstract but my debt is my hedge against the inflation which must happen at some point due to the profligate policies in Washington. Personally, I have near one million dollars in real-estate debt. Two of my three properties are rentals. The other I live in. Once inflation inevitably kicks in, my debts will be worth much less in constant terms.

My brother disapprovingly tells me that I am betting against America. This is absolutely true. I can’t help what our betters in Washington are doing to this country but I can profit from it.

That is a good play if the Canadian real estate market was not in a huge bubble as it is now. If you wait 6 months and the US market bottoms there will be great deals to be had if you lock in at the low rates.

Unless you purchased these properties 10 years ago (where prices will settle back to) you are screwed.

Uh… Ragnar

When inflation goes up so do interest rates. When interest rates go up it’s harder to borrow money to buy property. This means people are less able to buy property. This means the value of property goes down. The payments on your million bucks go up too. In 1980 rates reached 20%. Do the math, interest paid on a million goes up from $50,000 to $200,000 per annum. That’s gotta hurt.

Doesn’t stop there either, businesses struggle under inflation, wages up, inputs up, profits down, layoffs and unemployment goes up. Dollar goes up as interest rates are high. Exports struggle. Even less jobs.

The only entity that benefits from inflation are those who own the debt. That would be government. Banks that hold long debt lose. Which means banks expecting inflation don’t lend long. Even less uncertainty for business. Which means they are even less likely to invest for the future. Even less jobs.

In the end, it catches up with government as well. Less revenue, less taxes, higher tax rates for taxpayers and we’re all eating Souvlaki and Baklava.

Enjoy.

ragnar spoken like a true marxist, profit from others pain.

scummy or what?

Hold the presses! Nothing even remotely Marxist whatsoever!

Ragnar is taking personal risk in a capitalist endeavor with the intention of earning a profit. He’s putting his ass on the line…nobody else. He’s providing a service (a house to rent) that consumers can purchase or ignore as they see fit. Nobody is forced to live in his house, buy it, sell it, or even like it. He’ll reap the rewards and endure the losses.

That’s as far as humanly possible from Marx and I wish Ragnar the best of luck.

Ummm… just one stupid question Ragnar.

If the rampant inflation you speak of happens. (and I am as concerned that is will as you are)…. Won’t the result be that no one really has the cash to purchase your revenue homes?? Conditions which inevitably lead to lower prices since there would be supply, but not much demand.

And if the result becomes that prices drop, doesn’t that drop your investment?? And therefore increase the Debt:Asset making your hedge not only meaningless as a hedge, but dangerous to your fiscal health as the debt won’t go away as your hosing investment deflates both against inflation and in real dollars?

Don’t get me wrong, I am glad you have a business that you are using to support your family, we need more productive members of society… I just don’t think your debt “investment” will work the way you think it will when said inflation comes calling. I think it will impact you more negatively than positively. (Especially if the property is damaged in the riots that usually accompany rapid and extreme deflation)