One evening after work I was pondering my finances. I’m concerned about them. You’re concerned about your finances too. If you aren’t you’re either deluded, dependent, or in denial. Economic uncertainty entails risk which cannot be wholly mediated.

So what did I do? Weep? Attack the liquor cabinet? Watch FOX? Of course not!

I fired up my woodsplitter (which is inexplicably running flawlessly) and got to work. I worked of my own volition, alone, at my own pace, and quit when the sun set. There’s a simplicity to certain labors that’s noticeably absent elsewhere.

Did I wrap up my winter’s fuel needs? Not by a long shot. (I’m way behind my goals as usual.) But I made progress and the pile of prepared firewood went from “none” to “some”. Thus the number of weeks for which my home heating is assured went from “none” to “some”.

Firewood belongs to an interesting group of self-reliant “hard assets” which are (in some ways) better than cash. To begin with they’re infinitely more predictable. Despite what Al Gore would have you believe, it’s a certainty that it will be cold in the winter. Thus it is a certainty that my firewood is of value.

Financial instruments (even cash) are ephemeral; digits backed by a system of ideas. Firewood is solid, real, and undeniable. The wood pile is mine and mine alone. It is on my yard and on my property. I don’t need a title and serial number to prove ownership. It won’t be taxed. It won’t be tracked. It isn’t likely to be stolen. It won’t be subject to late charges, administrative fees, or licensing agreements. It won’t depreciate, it gains quality as it dries, and it stores indefinitely. It is not subject to identity theft or lost paperwork. It’s not affected by inflation. If the stock market crashes it won’t vanish. If my credit rating tanks it won’t move an inch. War, peace, oil embargoes, elections, and unemployment won’t affect it. It’s a very hard thing to devalue and it’s impossible to deny it’s existence. Try that with a 401(k), Enron stock, or even your checkbook.

When you think about it like that, a simple woodstove is practically rebellious. How often do you enjoy the fruits of your labors without a middleman and taxes?

I put in a couple hours of good old fashioned hard labor and slept well that night. Either I was at peace from progress toward a warm winter or my muscles were tired. Perhaps society could use that peace too.

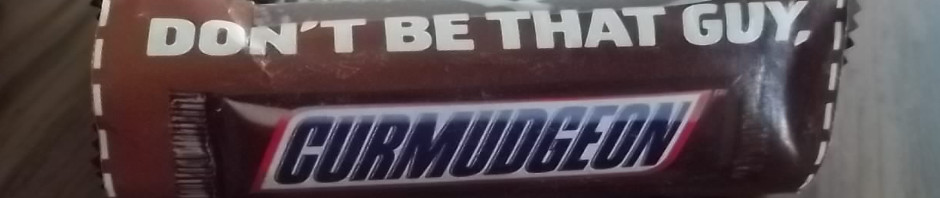

Is America jittery because all it’s “wealth” is just numbers in databases? Numbers that are unimaginably huge and subject to political tinkering aren’t inherent in the human mind. We had to be taught that a bank statement is the same as stuff. It’s my Curmudgeonly opinion that society could use a few steps back from the virtualization of everything we own. A computer hiccup can delete either my checkbook or this blog in a nanosecond but a complete global economic meltdown wouldn’t alter my woodpile. Perhaps the difference between the two isn’t something we can condescendingly ignore?

My answer for every one of your questions is “yes”.

TThis is great! Linked.

Thanks for the link!